From record-breaking enrollments to exciting new partnerships, 2024 was a year of growth and success for Ritter Insurance Marketing!

Below, we’re covering the highlights as we recap the State of the Senior Market for 2025.

Reviewing Ritter’s 2024

Behind the scenes, Ritter experienced another prosperous year! We have 265 full-time employees nationwide and a presence and offices in 11 states. We couldn’t be more thankful for our knowledgeable and dedicated staff!

For one 2025 change, the Ritter IT and software development teams transitioned to the full-time support of Integrity products. They are still hard at work making sure our technology is the best it can be!

By the Numbers

Medicare Advantage (MA) production for 2024 increased 32 percent, totaling 164,059 enrollments! With Medicare Supplements, Ritter saw an eight percent increase in premium production, totaling $46,818,000, throughout the full plan year. Finally, with Medicare Part D, we saw an increase of 19 percent in enrollments from last year, for a total of 51,835 enrollments.

We look to the next plan year with excitement and anticipation!

Our 2025 Annual Enrollment Period (AEP) saw some huge growth in MA plans. Our total number of AEP-specific MA enrollments was up an impressive 55 percent from the 2024 AEP, totaling 99,127. Our Part D enrollments were down 79 percent compared to the previous AEP, for a total of 6,092. Our grand total of enrollments for the 2025 AEP was 105,219. We couldn’t be more proud of this accomplishment, and it would not have been possible without our hardworking and devoted agents!

Our grand total of enrollments for the 2025 AEP was 105,219.

We also added four Medicare carriers — Essence Health, Sonder Health, UCLA Health, and VillageCareMAX!

Three ACA/individual health insurance carriers — Medica, MetroPlusHealth, and Wellpoint — are now available through Ritter as well!

Technology Advancements

This past year, we made technology enhancements to help make our tools and resources the best they possibly can be for our agents.

We transitioned to Integrity tools like PlanEnroll and IntegrityCONNECT, which allow agents to connect with consumers and easily manage all aspects of their business.

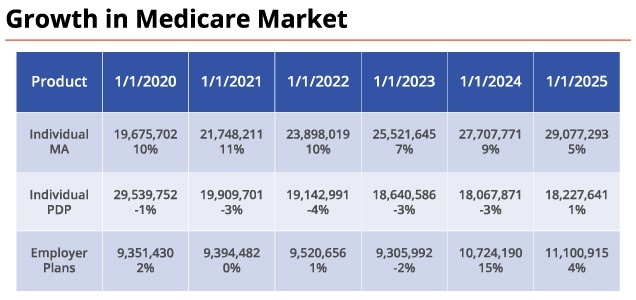

Plan Year 2024 Medicare Enrollment Stats

In 2024, MA plan enrollment continued to rise but at a slower growth rate than previous years.

Growth by Plan Type

Individual MA enrollments were up five percent as of February 1, 2025! UnitedHealthcare once again emerged as the MA market leader, with more than nine million enrollees at the beginning of February 2025. Humana trailed UnitedHealthcare, taking second place, and CVS/Aetna trailed both, taking third. Cigna Healthcare and Healthfirst saw notable growth in MA enrollments, with a 17 percent positive year-over-year change. Additionally, Lifetime (Excellus) saw an impressive 19 percent year-over-year change! Overall, regional plans outperformed national plans.

Special Needs Plans (SNPs) had a 10 percent year-over-year growth, proving they are a rising MA product! Try adding SNPs to your portfolio to help even more clients! During the AEP, Traditional HMOs outperformed local PPOs for the first time in several years.

Looking at PDPs, enrollment increased by about one percent, which is an improvement from a decrease of three percent in 2024.

Growth by State

Pennsylvania, Ritter’s home state, had the highest number of enrollments — 32,734. Michigan and Florida followed with 32,145 and 31,792 enrollments, respectively. New York saw the most plan terminations this past year.

In the recording of the address, we dive deeper into carrier growth per state, so check that out if you want additional localized insight!

Medicare Regulation and Legislation & Industry Trends

The 2025 plan year led to some updates that could alter the way the Medicare industry operates.

Projecting 2026 Commissions

While these numbers aren’t released until the end of May, we expect an increase higher than 2.4 percent for MA plans in 2025.

CY 2026 Part D Standard Benefit

In 2026, the annual true out-of-pocket costs will be capped at $2,100 for those enrolled in Medicare Part D. This is an increase of $100 from 2025. The deductible will be $615, which is a $25 increase from 2025.

The defined Part D prescription drug coverage benefits will consist of three phases:

- Deductible — The enrollee pays 100 percent of their covered prescription drug costs (GCPDC) until the deductible of $615 for CY 2026 is met.

- Initial coverage — The enrollee pays 25 percent coinsurance for covered Part D drugs until the out-of-pocket cost hits $2,100.

- Catastrophic — The enrollee pays no cost-sharing for covered Part D drugs.

Enrollees will also have the option to pay out-of-pocket prescription drug costs via capped monthly payments.

Part D Demonstration Project

This project from the Centers for Medicare & Medicaid Services (CMS) was started to lower Part D costs and improve benefits.

CMS applies a uniform reduction of $15 a month to the base premium for all participating stand-alone prescription drug plans (PDPs). There is also a year-over-year increase limit of $35 per month on a plan’s total Part D premium.

All major plans participated this year. We predict that legislators won’t change anything about the PDP benefit, and the likelihood of the Inflation Reduction Act (IRA), of which the redesign was part, being pulled back is low at this point.

Implications to Part D Design Changes

As a result of the IRA & Part D redesign, a lot of MA plans have shifted their focus from offering more comprehensive and customized benefits to a more basic level of coverage — including coinsurance and a deductible on the prescription drug benefit — in order to control costs. There are also a smaller number of stand-alone Part D plan carriers, and we’ve seen stand-alone Part D sponsors cutting commissions.

We predict it could take several years for Managed Care Organizations and Part D sponsors to get comfortable with the new benefit changes.

2024 Final Rule Agent/Broker Compensation Update

CMS proposed to make changes to prohibit “any terms that could reasonably be expected to inhibit an agent or broker’s ability to objectively assess and recommend” which plans best meet a beneficiary’s needs. Some examples are HRA payments, marketing allowances, leads, and admin or override fees.

Americans for Beneficiary Choice (ABC) sued CMS and received a stay on the section of the Final Rule that disrupted the existing model for broker compensation. If ABC succeeds, the Department of Justice can appeal to the 5th Circuit or drop the case. If CMS succeeds, the stay will remain in force while ABC has the opportunity to appeal.

Most Recent Proposed Rule

CMS’ proposed MA & Part D rule for plan year 2026 could bring many changes for agents.

One change is the elimination of the “content” standard. All communication material that meets the existing “intent” standard — including all generic marketing — will be considered marketing material and needs to be filed with CMS. Craig is working hard to remove this from the current proposed proposal.

There are also more requirements proposed for agent presentations, including being required to discuss the potential impacts that enrolling in an MA plan would have on eligibility for Medigap guarantee issue rights.

If you want to view the current requirements, you can check out Ritter’s MA & PDP Compliance Sales Checklist!

Ritter’s CEO, Craig Ritter, wants to be your advocate when it comes to the Medicare space and aims to emphasize an agent’s role in the enrollment process.

We’re excited to see what’s in store for the future of Medicare, and we hope to keep helping agents find success in the business!

If you were unable to attend this year’s State of the Senior Market address, you can watch the recording here whenever you’d like! If you aren’t yet a Ritter agent, register with us today to start selling smarter than ever with an excellent partner by your side.

Not affiliated with or endorsed by Medicare or any government agency.

Share Post